" "Quantitative trading" has two meanings: one is in a narrow sense, which refers to the content of quantitative trading, which converts trading conditions into programs and automatically places orders; second, in a broad sense, it refers to the systematic trading mode, which is a comprehensive trading system.

Quantitative trading refers to the securities investment method that uses modern statistical and mathematical methods and computer technology to trade, which greatly reduces the impact of investors' mood swings and avoids making irrational investment decisions when the market is extremely fanatical or pessimistic.

Stock quantification is also known as quantitative trading. There are two concepts in a broad sense and a narrow meaning. Stock quantification in a narrow sense refers to the content of quantitative trading, which converts trading conditions into programs and automatically places orders; Stock quantification in a broad sense refers to a systematic trading method, which is a comprehensive trading system.

Quantitative Trading is the use of mathematical, statistical and computer models and methods to guide transactions in the financial market. It can automatically place orders or semi-automatically. This is not the core. The core is whether it is a systematic transaction (sy Stematic trading).

1. Simply put, quantitative trading is a method of relying on computer programs to implement investment strategies. For example, there is a very famous trading strategy in finance called momentum trading, which means buying when the stock price breaks up and selling when it falls.

2. First of all, we should understand the basic situation of the futures market. Secondly, you should expand your knowledge and learn simple technical analysis. Thirdly, we need to have a relatively perfect trading system and strictly stop loss and take profit. Finally, you should learn to control your mentality. At the beginning, try to watch more and move less, and don't trade too frequently.

3. Do the function by yourself. Finally, there are some platforms in China now, and their data is very convenient.There are some functions that do not require investors to write by themselves at all. Investors only need to refer to some of their performance indicators to make it easier for investors to operate.

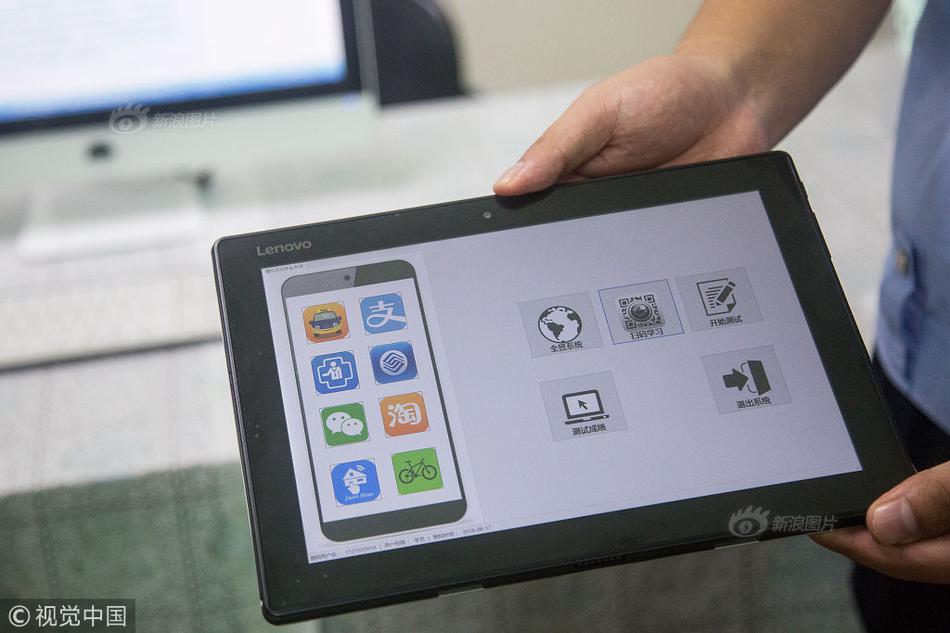

4. The methods of self-study quantitative trading include: understanding basic concepts, learning financial market knowledge, mastering programming skills, learning quantitative trading strategies, practicing backtesting and optimization, continuous learning and improvement. Understand the basic concepts. Before you start learning quantitative trading, you need to have a clear understanding of the basic concepts of quantitative trading.

5. Before preparing to enter the door of quantitative trading, we need to understand what quantitative trading is. Quantitative trading is not so much an industry as a method of trading, which corresponds to subjective trading. Subjective trading is a trader (in this book: investor = speculator = trader.

6. The advantages of quantitative investment lie in discipline, systematicity, accuracy and strict risk control. Quantitative technologies such as quantitative stock selection, quantitative timing selection, stock index futures arbitrage, algorithmic trading, asset allocation, etc. can almost cover the whole investment process.

offline physical stores of CITIC Securities, Shenwan Hongyuan, Galaxy Securities, etc., find the staff in the physical store with your transaction number and ID card. On the online official website of CITIC Securities, Shenwan Hongyuan, Galaxy Securities, etc., the operation can be carried out after applying for an account through the online account manager.

You can buy it in the quantitative system on the home page of the stock software. How to buy and how to sell. Buy tickets and sell tickets, the algorithm of the Strategy Department has done a good job of buying and selling the day before the opening of the day.

If retail investors want to use quantitative trading, they may need to set up a "conditional order" by themselves. After the exchange order is set, the system will operate according to this instruction. In addition, some companies have special quantitative trading software, but investors need to pay for it, so you should ask yourself to open an account for specific operation. Division.

First of all, determine your investment concept. Whether to choose stocks through the historical value of stocks or according to the current investment trend, and then reasonably choose which indicators to judge the historical value and the investment trend, the indicators should be clear and quantifiable. Choose quantitative trading strategies.

Trend trading, that is, buying in an uptrend and selling in a downtrend. Carry out reasonable position management, that is, adopt funnel position management method, rectangular position management method, pyramid position management method, etc., to cope with the risks in the later stage of stocks.

If retail investors want to use quantitative trading, they may need to set up "conditional orders" by themselves. After the exchange order is set, it isTong will operate according to this instruction. In addition, some companies have special quantitative trading software, but investors need to pay for it, so you should ask your own account opening securities company for specific operation.

First of all, it is necessary to formulate quantitative trading strategies according to personal investment style and risk preferences. Quantitative trading strategies generally include transaction subject, investment period, take-profit and stop-loss points, capital management and other aspects.

There is no opinion on the market at any time. It's okay to go any way, and it's right to go anyway. All kinds of situations should be well planned before the market, and each has its own response during the market. 10 In fact, what needs to be analyzed and solved is whether the market is a one-sided trend or a shock trend. Finalize the intervention point of the transaction. 11 Analysis and prediction should be disconnected from the execution of transactions.

Accuracy: Quantitative trading can more accurately predict market trends, so as to better achieve investment goals.Low cost: Quantitative trading can effectively reduce investment costs, so as to achieve investment goals more effectively.

Trade with the trend, that is, buy in the upward trend and sell in the downward trend. Carry out reasonable position management, that is, adopt funnel position management method, rectangular position management method, pyramid position management method, etc., in order to cope with the later risks of individual stocks.

The profit of each transaction is relatively small, so there are not many varieties with high liquidity and volatility that can be provided. Every quantitative transaction requires a spread or commission. And these expenses are fixed. The shorter the time cycle, the smaller the profit margin of the system.

Core concept: The core concept of the Boer system is to quantify funds in the band operation and quantify the price in the short-term operation. Core function: Core function 1: The function of quantitative processing of transaction funds is called "dominant kinetic energy". Core function 2: The function of quantifying the transaction price is called "multi-empty probability".

The quantitative trading system of Bol Securities has three characteristics: looking at the market from different perspectives. Most investors look at the market at the Shanghai Stock Exchange Index, but the Shanghai Stock Exchange is prone to the influence of weighted stocks and distortion of the market response. The quantitative trading system of Boer Securities reflects the real situation of the market through the tracking of the Boer index.

I personally experienced it. It's very general. The quantitative system still recommends the grayscale quantitative trading system.

Quantitative system, don't buy it. There is no practicality of ordinary indicators.I was fooled. You want me to give it to you for free.

What does quantitative trading in the stock market meanHS code compliance for South American markets-APP, download it now, new users will receive a novice gift pack.

" "Quantitative trading" has two meanings: one is in a narrow sense, which refers to the content of quantitative trading, which converts trading conditions into programs and automatically places orders; second, in a broad sense, it refers to the systematic trading mode, which is a comprehensive trading system.

Quantitative trading refers to the securities investment method that uses modern statistical and mathematical methods and computer technology to trade, which greatly reduces the impact of investors' mood swings and avoids making irrational investment decisions when the market is extremely fanatical or pessimistic.

Stock quantification is also known as quantitative trading. There are two concepts in a broad sense and a narrow meaning. Stock quantification in a narrow sense refers to the content of quantitative trading, which converts trading conditions into programs and automatically places orders; Stock quantification in a broad sense refers to a systematic trading method, which is a comprehensive trading system.

Quantitative Trading is the use of mathematical, statistical and computer models and methods to guide transactions in the financial market. It can automatically place orders or semi-automatically. This is not the core. The core is whether it is a systematic transaction (sy Stematic trading).

1. Simply put, quantitative trading is a method of relying on computer programs to implement investment strategies. For example, there is a very famous trading strategy in finance called momentum trading, which means buying when the stock price breaks up and selling when it falls.

2. First of all, we should understand the basic situation of the futures market. Secondly, you should expand your knowledge and learn simple technical analysis. Thirdly, we need to have a relatively perfect trading system and strictly stop loss and take profit. Finally, you should learn to control your mentality. At the beginning, try to watch more and move less, and don't trade too frequently.

3. Do the function by yourself. Finally, there are some platforms in China now, and their data is very convenient.There are some functions that do not require investors to write by themselves at all. Investors only need to refer to some of their performance indicators to make it easier for investors to operate.

4. The methods of self-study quantitative trading include: understanding basic concepts, learning financial market knowledge, mastering programming skills, learning quantitative trading strategies, practicing backtesting and optimization, continuous learning and improvement. Understand the basic concepts. Before you start learning quantitative trading, you need to have a clear understanding of the basic concepts of quantitative trading.

5. Before preparing to enter the door of quantitative trading, we need to understand what quantitative trading is. Quantitative trading is not so much an industry as a method of trading, which corresponds to subjective trading. Subjective trading is a trader (in this book: investor = speculator = trader.

6. The advantages of quantitative investment lie in discipline, systematicity, accuracy and strict risk control. Quantitative technologies such as quantitative stock selection, quantitative timing selection, stock index futures arbitrage, algorithmic trading, asset allocation, etc. can almost cover the whole investment process.

offline physical stores of CITIC Securities, Shenwan Hongyuan, Galaxy Securities, etc., find the staff in the physical store with your transaction number and ID card. On the online official website of CITIC Securities, Shenwan Hongyuan, Galaxy Securities, etc., the operation can be carried out after applying for an account through the online account manager.

You can buy it in the quantitative system on the home page of the stock software. How to buy and how to sell. Buy tickets and sell tickets, the algorithm of the Strategy Department has done a good job of buying and selling the day before the opening of the day.

If retail investors want to use quantitative trading, they may need to set up a "conditional order" by themselves. After the exchange order is set, the system will operate according to this instruction. In addition, some companies have special quantitative trading software, but investors need to pay for it, so you should ask yourself to open an account for specific operation. Division.

First of all, determine your investment concept. Whether to choose stocks through the historical value of stocks or according to the current investment trend, and then reasonably choose which indicators to judge the historical value and the investment trend, the indicators should be clear and quantifiable. Choose quantitative trading strategies.

Trend trading, that is, buying in an uptrend and selling in a downtrend. Carry out reasonable position management, that is, adopt funnel position management method, rectangular position management method, pyramid position management method, etc., to cope with the risks in the later stage of stocks.

If retail investors want to use quantitative trading, they may need to set up "conditional orders" by themselves. After the exchange order is set, it isTong will operate according to this instruction. In addition, some companies have special quantitative trading software, but investors need to pay for it, so you should ask your own account opening securities company for specific operation.

First of all, it is necessary to formulate quantitative trading strategies according to personal investment style and risk preferences. Quantitative trading strategies generally include transaction subject, investment period, take-profit and stop-loss points, capital management and other aspects.

There is no opinion on the market at any time. It's okay to go any way, and it's right to go anyway. All kinds of situations should be well planned before the market, and each has its own response during the market. 10 In fact, what needs to be analyzed and solved is whether the market is a one-sided trend or a shock trend. Finalize the intervention point of the transaction. 11 Analysis and prediction should be disconnected from the execution of transactions.

Accuracy: Quantitative trading can more accurately predict market trends, so as to better achieve investment goals.Low cost: Quantitative trading can effectively reduce investment costs, so as to achieve investment goals more effectively.

Trade with the trend, that is, buy in the upward trend and sell in the downward trend. Carry out reasonable position management, that is, adopt funnel position management method, rectangular position management method, pyramid position management method, etc., in order to cope with the later risks of individual stocks.

The profit of each transaction is relatively small, so there are not many varieties with high liquidity and volatility that can be provided. Every quantitative transaction requires a spread or commission. And these expenses are fixed. The shorter the time cycle, the smaller the profit margin of the system.

Core concept: The core concept of the Boer system is to quantify funds in the band operation and quantify the price in the short-term operation. Core function: Core function 1: The function of quantitative processing of transaction funds is called "dominant kinetic energy". Core function 2: The function of quantifying the transaction price is called "multi-empty probability".

The quantitative trading system of Bol Securities has three characteristics: looking at the market from different perspectives. Most investors look at the market at the Shanghai Stock Exchange Index, but the Shanghai Stock Exchange is prone to the influence of weighted stocks and distortion of the market response. The quantitative trading system of Boer Securities reflects the real situation of the market through the tracking of the Boer index.

I personally experienced it. It's very general. The quantitative system still recommends the grayscale quantitative trading system.

Quantitative system, don't buy it. There is no practicality of ordinary indicators.I was fooled. You want me to give it to you for free.

What does quantitative trading in the stock market meanHS code intelligence in freight auditing

author: 2024-12-24 01:02GCC HS code-based tariff systems

author: 2024-12-24 00:51HS code-based opportunity scanning

author: 2024-12-24 00:46Global trade data accuracy improvement

author: 2024-12-24 00:18Food additives HS code classification

author: 2024-12-23 22:31How to find authorized economic operators

author: 2024-12-24 01:04Trade data for strategic sourcing

author: 2024-12-24 00:28Data-driven trade procurement cycles

author: 2024-12-23 23:12HS code-based customs broker RFPs

author: 2024-12-23 22:32 HS code-based alternative sourcing strategies

HS code-based alternative sourcing strategies

259.66MB

Check Trade data for logistics companies

Trade data for logistics companies

655.63MB

Check Real-time cargo tracking solutions

Real-time cargo tracking solutions

432.73MB

Check Top-rated trade management software

Top-rated trade management software

143.29MB

Check How to find emerging export markets

How to find emerging export markets

115.54MB

Check Electronics global shipment tracking

Electronics global shipment tracking

356.63MB

Check HS code-facilitated PL selection

HS code-facilitated PL selection

828.74MB

Check Trade data-driven credit insurance

Trade data-driven credit insurance

934.72MB

Check Global cross-border payment tracking

Global cross-border payment tracking

624.21MB

Check International trade database customization

International trade database customization

653.22MB

Check Global trade documentation templates

Global trade documentation templates

893.35MB

Check Automated import export risk alerts

Automated import export risk alerts

712.92MB

Check How to ensure data-driven export strategies

How to ensure data-driven export strategies

177.21MB

Check US-China trade data comparisons

US-China trade data comparisons

865.45MB

Check Trade data-driven contract negotiations

Trade data-driven contract negotiations

771.25MB

Check HS code-based tariff reconciliation

HS code-based tariff reconciliation

887.12MB

Check Latin America HS code classification

Latin America HS code classification

556.87MB

Check Trade data-driven portfolio management

Trade data-driven portfolio management

276.29MB

Check HS code-driven tariff equalization

HS code-driven tariff equalization

149.43MB

Check How to find compliant suppliers

How to find compliant suppliers

288.22MB

Check Predictive analytics in international trade

Predictive analytics in international trade

854.11MB

Check How to analyze competitor shipping routes

How to analyze competitor shipping routes

978.12MB

Check Free zone HS code compliance

Free zone HS code compliance

574.71MB

Check Steel industry HS code references

Steel industry HS code references

328.58MB

Check HS code-based tariff calculations

HS code-based tariff calculations

164.42MB

Check import export database

import export database

539.59MB

Check Real-time supplier performance scoring

Real-time supplier performance scoring

475.87MB

Check Predictive trade infrastructure analysis

Predictive trade infrastructure analysis

857.24MB

Check supply chain intelligence

supply chain intelligence

626.88MB

Check Dried fruits HS code classification

Dried fruits HS code classification

941.19MB

Check Country-specific HS code conversion charts

Country-specific HS code conversion charts

559.19MB

Check Carbon steel HS code references

Carbon steel HS code references

686.83MB

Check Top-rated trade management software

Top-rated trade management software

914.43MB

Check Global trade risk heatmaps

Global trade risk heatmaps

884.18MB

Check Industry-specific trade tariff analysis

Industry-specific trade tariff analysis

672.47MB

Check Dehydrated vegetables HS code references

Dehydrated vegetables HS code references

627.96MB

Check

Scan to install

HS code compliance for South American markets to discover more

Netizen comments More

879 How to identify top importing countries

2024-12-24 00:47 recommend

2359 Global trade data accuracy improvement

2024-12-24 00:39 recommend

1210 Latin America HS code classification

2024-12-24 00:31 recommend

807 Trade data for intellectual property checks

2024-12-23 23:46 recommend

762 HS code compliance in cross-border rail freight

2024-12-23 23:25 recommend